Make the following voucher entries :

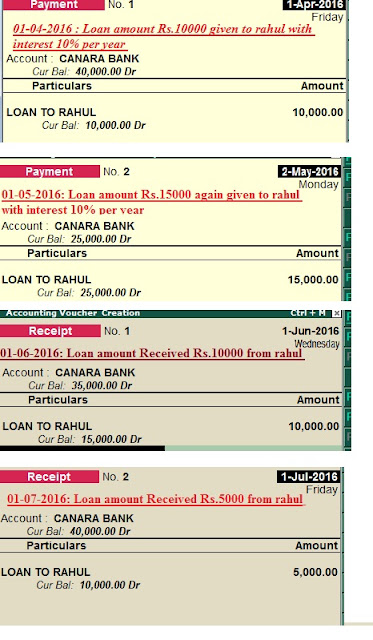

01-04-2016 : Loan amount Rs.10000 given to rahul with interest 10% per year

01-05-2016: Loan amount Rs.15000 again given to rahul with interest 10% per year

01-06-2016: Loan amount Received Rs.10000 from rahul

01-07-2016: Loan amount Received Rs.5000 from rahul

Steps :

1.Features Setting : Before You Make Interest Calculation in Tally9 Pls Check Follows:

- In Gateway of Tally > Press F11 (Company Features) > Accounting Features > Activate Interest Calculation : Yes (Use Advance Parameters : No)

- In Gateway of Tally > Press F12 (Configuration) > Accts/Inventory Info > Allow Advanced Entries in Masters :Yes.

- In Gateway of Tally > Press F12 (Configuration) > Voucher Entry > Use Single Entry Mode for Pymt/Rcpt/Contra : Yes.

In Gateway of Tally > In Accounts Info > Ledgers > Create

1) Name : Loan to Rahul--------- Under : Loans and Advances (Asset)

Activate Interest Calculation : Yes.

Rate 10 % Per Calender Year.

2) Name : Central Bank of India Under : Bank Accounts , Opening Balance :Rs.50000

3. Voucher Entry :

01-04-2016 : Loan amount Rs.10000 given to rahul with interest 10% per year

Gateway of tally 9 > Accounting Voucher > Press F5 ( Payment Voucher ) > Press F2 : 01-04-2016 >

Account : Central Bank of India >

Particulars: Loan to Rahul ---- Rs.10000 >

(Note : Press Enter to again and again upto Accept yes or Press CTRL + A to Accept Immediatly)

01-05-2016: Loan amount Rs.15000 again given to rahul with interest 10% per year

In Same Payment Voucher(F5) > Press F2 : 02-05-2016 (Change the Date) >

Account : Central Bank of India >

Particulars: Loan to Raju ---- Rs.15000 > (After entering amount rs.15000 Press CTRL + A to Accept Immediatly)

01-06-2016: Loan amount Received Rs.10000 from rahul

Press F6 ( Receipt Voucher ) > Press F2 : 01-06-2016 >

Account : Central Bank of India >

Particulars: Loan to Rahul---- Rs.10000 >

01-07-2016: Loan amount Received Rs.5000 from rahul

Press F6 ( Receipt Voucher ) > Press F2 : 01-07-2016 >

Account : Central Bank of India >

Particulars: Loan to Rahul---- Rs.5000>

So Over all Rs.25000 given to rahul and Rs.15000 received from rahul . so how calculate the interest :

4.Reports :

- In Gateway of Tally > Display > Statements of Accounts > Interest Calculation >Ledger> Select : Loan To Raju >

- Press F2 Change Period > From : 01-04-2016 To : 01-05-2016 > You can see the report

5.Screen Shots :10000 – 1-apr-2016 – 1-may-2016 – 30 Days – 10 % – 82.19 DrAgain Change F2 > From : 01-04-2016 To : 01-06-2016 > Now..10000 – 1-apr-2016 – 2-may-2016 – 31 Days – 10 % – 84.93 Dr25000 – 2-may-2016 – 1-june-2016 – 30 Days – 10 % – 205.48 Dr(10000+ 5000=25000)Again Change F2 > From : 01-04-2016 To : 01-08-2016 > Now..Again Change F2 > From : 01-04-2016 To : 01-03-2017 > Now..(Every time 10% Calculated based on ledger interest )

5.1 Features and Configuration Settings :

Thanks